Multiple Choice

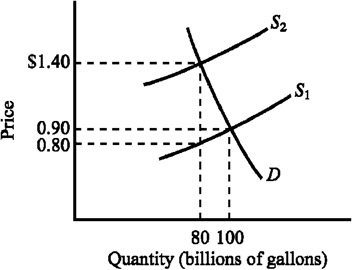

Use the figure below to answer the following question(s) .

Figure 4-7

Refer to Figure 4-7. Which of the following is true for the tax illustrated?

A) The tax increases the price of gasoline by $.60.

B) Since the demand for gasoline is more inelastic than the supply, consumers bear most of the burden of the tax.

C) Since the demand for gasoline is more elastic than the supply, consumers bear most of the burden of the tax.

D) Since the supply of gasoline is highly inelastic, the primary burden of the tax is imposed on the suppliers of gasoline.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Which of the following statements regarding black

Q40: A price ceiling that sets the price

Q76: If Joan pays $5,000 in taxes when

Q78: Use the table below to choose the

Q81: Suppose a property tax of $300 per

Q85: The deadweight loss resulting from levying a

Q93: Government programs such as Medicare substantially subsidize

Q100: Which of the following statements is true?<br>A)

Q128: If the supply of health care services

Q209: The more inelastic the demand for a