Multiple Choice

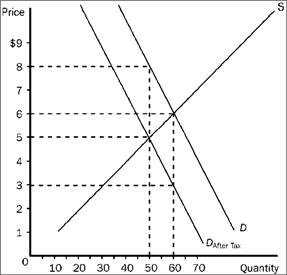

Figure 4-20

Refer to Figure 4-20. The burden of the tax on sellers is

A) $1.00 per unit.

B) $1.50 per unit.

C) $2.00 per unit.

D) $3.00 per unit.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Other things constant, if a labor union

Q174: A progressive tax is defined as a

Q191: Figure 4-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-20

Q193: Rent controls generally fix the price of

Q194: A politician was recently quoted as saying,

Q197: Use the figure below to answer the

Q198: Use the figure below to answer the

Q199: During the Prohibition period (when the production

Q200: Figure 4-15 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-15

Q224: How would a decrease in lumber prices