Multiple Choice

Figure 4-21

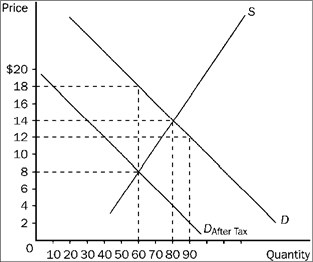

Refer to Figure 4-21. The amount of the tax per unit is

A) $10.

B) $6.

C) $4.

D) $2.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q61: Suppose an excise tax is imposed on

Q68: Which one of the following will most

Q221: How would an increase in the price

Q229: An excise tax levied on a product

Q240: Use the figure below to answer the

Q241: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-22

Q242: If a $5,000 property tax is placed

Q246: The average tax rate (ATR) is defined

Q247: Use the figure below to answer the

Q248: Figure 4-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9057/.jpg" alt="Figure 4-22