Multiple Choice

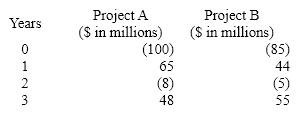

Gamma Inc. is considering two mutually exclusive projects with the following cash flows. Based on their approximate MIRRs, which project should the company accept? Gamma's cost of capital is 8%.

A) Project A, as it has an MIRR of 8%

B) Project B, as it has an MIRR of 5%

C) Project A, as it has an MIRR of 6%

D) Project B, as it has an MIRR of 6%

Correct Answer:

Verified

Correct Answer:

Verified

Q144: The mutually exclusive decision rule for the

Q145: The equivalent annual annuity method replaces each

Q146: A project generates a revenue of $100.00

Q147: What is the net present value of

Q148: The objective in solving capital rationing problems

Q150: When choosing between two mutually exclusive projects

Q151: The future cash flows of a stand-alone

Q152: The profitability index (PI)is particularly useful in

Q153: You are considering a project with an

Q154: The net present value method assumes that