Multiple Choice

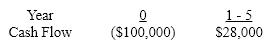

A stand-alone capital project has the following cash flows.  What is its NPV if the cost of capital is 10%?

What is its NPV if the cost of capital is 10%?

A) $106,142

B) ($6,142)

C) $934

D) $6,142

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Capital budgeting involves:<br>A)planning and justifying how capital

Q5: A firm's capital is 40% debt and

Q6: The profitability index technique is most meaningful

Q7: An outlay of $180,000 is expected to

Q8: A project having a payback period of

Q10: How is the MIRR better than the

Q11: If a proposed investment's payback period is

Q12: The following projects are all characterized by

Q13: A company evaluating projects when there is

Q14: Which of the following statement(s)is(are)true for the