Multiple Choice

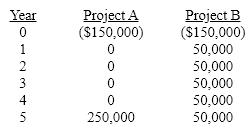

The projected cash flows for two mutually exclusive projects are as follows:  If the cost of capital is 10%, the decidedly more favorable project is:

If the cost of capital is 10%, the decidedly more favorable project is:

A) project B with an NPV of $39,539 and an IRR of 19.9%.

B) project A with an NPV of $5,230 and an IRR of 10.8%.

C) project A with an NPV of $39,539 and an IRR of 10.8%.

D) project B with an NPV of $5,230 and an IRR of 19.9%.

Correct Answer:

Verified

Correct Answer:

Verified

Q65: If a project's modified internal rate of

Q66: Rank order the following capital project types

Q67: Capital rationing may involve:<br>A)accepting projects with negative

Q68: Atlantis Inc. is considering two mutually exclusive

Q69: If a project's NPV is greater than

Q71: The MIRR is an interest rate that:<br>A)equates

Q72: The future cash flows of a stand-alone

Q73: The projected cash flows for two mutually

Q74: If a project has an initial cost

Q75: A project has the following cash flows: