Multiple Choice

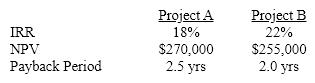

Capital budgeting analysis of mutually exclusive projects A and B yields the following:  Management should choose:

Management should choose:

A) project B because most executives prefer the IRR method.

B) project B because two out of three methods choose it.

C) project A because NPV is the best method

D) Either project because the results aren't consistent.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The following projects are all characterized by

Q13: A company evaluating projects when there is

Q14: Which of the following statement(s)is(are)true for the

Q15: What is the Profitability Index (PI)for the

Q16: When the NPV and IRR rules produce

Q18: What is the IRR of a project

Q19: Although quick and easy to apply, the

Q20: Swift Limited is considering a project with

Q21: If a net present value analysis for

Q22: The NPV decision rules are based on