Multiple Choice

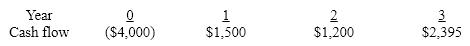

A stand-alone capital project has the following projected cash flows:  If the firm's cost of capital is 14%, which of the following statements is true?

If the firm's cost of capital is 14%, which of the following statements is true?

A) the IRR is greater than the cost of capital and the project should be undertaken

B) the project should be rejected because the IRR is 12%, which is less than the project's cost of capital

C) the IRR is less than 12% and the project should be undertaken

D) the NPV of the project is positive and the project should be undertaken

Correct Answer:

Verified

Correct Answer:

Verified

Q98: An investment project requires an initial outlay

Q99: Although the NPV method is technically superior,

Q100: Assume the following facts about a firm's

Q101: A firm has the following investment opportunities:

Q102: The internal rate of return is the

Q104: Business projects virtually always involve:<br>A)capital budgets.<br>B)early cash

Q105: Match the following:

Q106: A positive NPV implies an:<br>A)unacceptable project on

Q107: The first step in capital budgeting is

Q108: A project has the following cash flows: