Multiple Choice

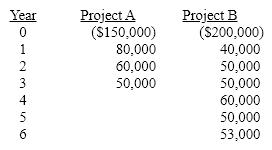

The projected cash flows for two mutually exclusive projects are as follows:  If the firm's cost of capital is 10% and the equivalent annual annuity method is used to eliminate the disparity between the projects' lives, which project should be undertaken?

If the firm's cost of capital is 10% and the equivalent annual annuity method is used to eliminate the disparity between the projects' lives, which project should be undertaken?

A) A

B) B

C) Either, because the difference in lives makes a comparison meaningless.

D) A, but the EAAs are so close that either is probably ok.

Correct Answer:

Verified

Correct Answer:

Verified

Q99: The internal rate of return method assumes

Q129: What is the IRR for a project

Q131: A project's _ is the sum of

Q132: A firm's financial managers have been asked

Q133: The projected cash flows for a project

Q135: The replacement chain and the equivalent annual

Q136: An assumption implicit in the net present

Q137: An outlay of $180,000 is expected to

Q138: Frazier Fudge, Inc. is considering 2 mutually

Q139: The difference between the cost of capital