Multiple Choice

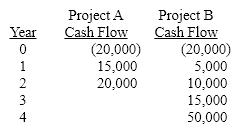

You are considering the following two mutually exclusive projects. Using the replacement chain approach and a cost of capital of 10%, calculate the NPV of Project A. (Round to nearest $)

A) $15,432

B) $16,113

C) $18,566

D) $25,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q76: Calculate the NPV for a project with

Q77: J&J Manufacturing is considering a project with

Q78: Which of the following can be used

Q79: Which of the following is most correct?<br>A)A

Q80: The projected cash flows for mutually exclusive

Q82: An investment project requires an outlay of

Q83: The first step in the capital budgeting

Q84: The net present value (NPV)method assumes that

Q85: A project is expected to last ten

Q86: The NPV and IRR techniques can give