Essay

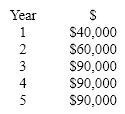

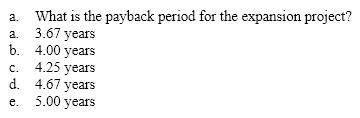

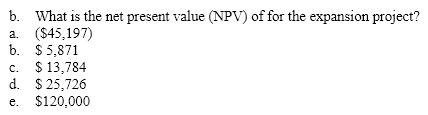

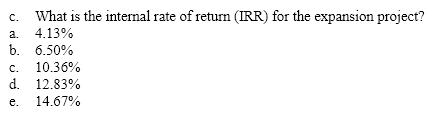

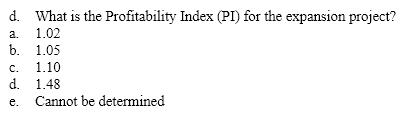

Use the following information for the next four questions. Norlin Corporation is considering an expansion project that will begin next year (Time 0). Norlin's cost of capital is 12%. The initial cost of the project will be $250,000, and it is expected to generate the following cash flows over its five-year life:

Correct Answer:

Verified

a. a (250 = 40 + 60 + 90 + 60/...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: If a project has a negative NPV,

Q40: The drawback in the replacement chain method,

Q41: Project A has a payback period of

Q42: What are the two primary drawbacks to

Q43: Incremental cash flows associated with capital budgeting

Q45: If the net present value of a

Q46: The modified internal rate (MIRR)of return eliminates

Q47: Which of the following is most correct?<br>A)Stand-alone

Q48: The future cash flows of a stand-alone

Q49: Projects are said to be mutually exclusive