Multiple Choice

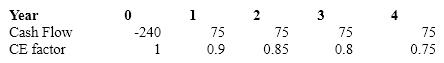

Zeta Inc.'s cost of capital is 12% and the risk-free rate is 5%. It plans to invest in a new project. The cash flow projections ($000) for the project are given below. Calculate the difference in the traditional NPV and the certainty equivalent NPV.

A) $9.43

B) $7.59

C) $30.35

D) $20.92

Correct Answer:

Verified

Correct Answer:

Verified

Q86: The most common type of an option

Q87: The various capital budgeting risk analysis techniques

Q88: Scenario and sensitivity analysis are helpful in

Q89: The certainty equivalent approach uses computer simulation

Q90: If the IRR is 10% APR for

Q92: The technique for incorporating Risk into capital

Q93: The concept of risk aversion from portfolio

Q94: Ignoring _ in capital budgeting can lead

Q95: Which of the following would not be

Q96: Komarek Forests is considering a new software