Essay

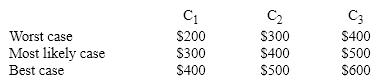

The Basalt Corporation is considering a new venture. Management has made the following cash flow estimates for the project over the next three years under assumptions reflecting best, worst, and most likely scenarios in each year.

Calculate the NPVs of the overall best, most likely, and worst case scenarios and the probability of each.

Calculate the NPVs of the overall best, most likely, and worst case scenarios and the probability of each.

Correct Answer:

Verified

Best case

CFo=-1,000, C01=400, C02=500...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

CFo=-1,000, C01=400, C02=500...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: An abandonment option will have an upfront

Q37: Modern techniques are very good at incorporating

Q38: How can a value be assigned to

Q39: Next year, a cash flow is expected

Q40: Multidivisional companies with diverse operations should use

Q42: Suppose a firm builds a plant with

Q43: Flexibility options let companies respond more easily

Q44: Which type of project is it most

Q45: Why may an analysis that makes even

Q46: Scenario analysis involves developing an NPV for