Essay

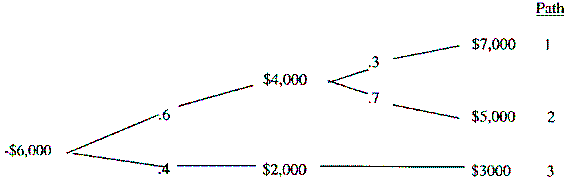

Reading Inc. is contemplating a project represented by the following decision tree. ($000).

Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

Reading is a small firm that is likely to be ruined by a project that loses more than $1.0 million. The firm's cost of capital is 14%. Calculate the project's expected NPV and make a recommendation regarding acceptance.

Correct Answer:

Verified

($000):

Recommendation: The project h...

Recommendation: The project h...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Average stocks are yielding 7.0%, while short

Q12: Portfolio theory makes it possible to incorporate

Q13: The cost of capital is the appropriate

Q14: A company is considering a project in

Q15: The _ method consists of regressing historical

Q17: Match the following:

Q18: In theory, the risk-free rate is more

Q19: Decision tree analysis shows a project to

Q20: The existence of an abandonment option raises

Q21: A _ is a course of action