Essay

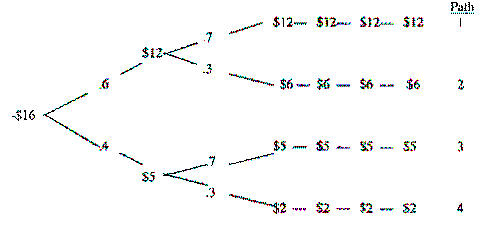

Kanick Corp is evaluating a new venture project and has developed the following decision tree analysis ($M).

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Kanick's cost of capital is 12% but a pure play competitor in the new field has been identified with a beta of 1.5. The average stock is returning 14% and treasury bills yield 6%. What is the venture's expected NPV. Discuss its risk characteristics.

Correct Answer:

Verified

The project has an expected NPV of over...

The project has an expected NPV of over...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: Ignoring _ in capital budgeting can lead

Q95: Which of the following would not be

Q96: Komarek Forests is considering a new software

Q97: Scenario analysis for a proposed new project

Q98: Why should a risk averse manager select

Q100: A real option that allows a company

Q101: Nash, Inc. is looking at a 4-year

Q102: Contico Corp is evaluating a capital budgeting

Q103: Which of the following is true of

Q104: If a low cash flow this year