Essay

The following information pertains to the capital program of a firm:

Target capital structure : 30% debt, 20% preferred stock, 50% equity.

Unadjusted component costs of capital kd = 10%

kp = 12%

ke = 14%

Flotation Costs, Taxes, and Retained Earnings Flotation costs are 8% on common and preferred stock and zero on debt

The total effective tax rate (federal and state)is 40%

Retained earnings of $1,250,000 are expected next year.

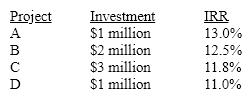

Investment Opportunities

Correct Answer:

Verified

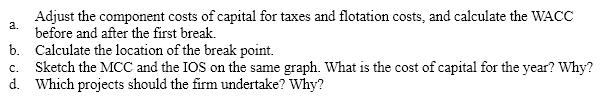

a. Cost of debt = kd(1-T) = 10(.6) = 6.0%...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The proportions of debt and equity used

Q8: Haverty Corp's bonds are selling to yield

Q9: If a project comes with its own

Q10: Learner Lanes, a producer of bowling balls,

Q11: Zimmerman Inc. issued $1,000, 25-year bonds 5

Q13: The components of a firm's capital are

Q14: To be accepted, projects that are unusually

Q15: Determine the (after-tax)component cost of a $50

Q16: Last year's dividend was $2.00, the anticipated

Q17: Match the following: