Multiple Choice

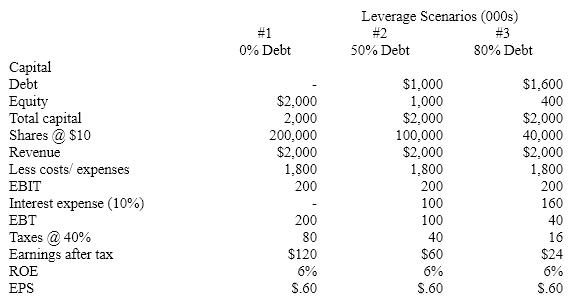

Consider the following leverage scenarios:  If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?

If under certain circumstances, financial leverage enhances performance measured by ROE and EPS, why does shifting from equity into debt have no effect in this case?

A) The company hasn't repurchased enough shares of stock with borrowed money.

B) The money the company is earning on its capital is exactly what it costs to borrow.

C) ROCE is too high.

D) ROCE is equal to the after tax cost of debt.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: A firm's financial leverage is a direct

Q57: Breakeven volume rises as variable costs are

Q58: Yang Centers wants to report at least

Q59: Fixed cost is also called:<br>A)expenses.<br>B)overhead.<br>C)variables.<br>D)depreciation.

Q60: Financial leverage involves substituting debt for equity

Q62: Financial leverage has the following effect on

Q63: Antarctic Corporation currently has the following financial

Q64: Operating leverage involves the use of:<br>A)equity and

Q65: Which of the following is not true

Q66: Leverage adds variability to financial performance when