Multiple Choice

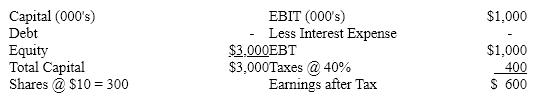

Assume the following facts about a company:  What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.

What will be the company's new EPS if it borrows money at 10% interest and uses it to retire stock until capital is 40% debt? The stock can be purchased at its book value of $10 per share.

A) $3.33

B) $4.89

C) $2.93

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: Kermit's Hardware's (KH)fixed operating costs are $20.8

Q19: Which of the following is true of

Q20: Southern Inc. has EBIT of $3,500,000, and

Q21: Assume the following facts about a firm

Q22: Business costs are either _ or can

Q24: If a firm has no debt and

Q25: Match the following:

Q26: A firm's operating leverage is a direct

Q27: The degree of operating leverage is the

Q28: DFL equals EBIT / (EBIT - I).