Multiple Choice

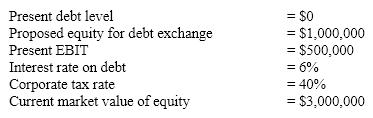

Assume the following selected financial information about a firm that is about to restructure capital by exchanging equity for debt:  What is the market value of the firm's equity after the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

What is the market value of the firm's equity after the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

A) $2,000,000

B) $2,264,000

C) $2,400,000

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q42: A company has EBIT of $2,400,000 and

Q43: A firm which has a 2.5 DOL

Q44: The combined impact of operating leverage and

Q45: Match the following:

Q46: If a firm can buy an item

Q48: It is a basic truth that financial

Q49: Harris Inc. has EBIT of $1,500 and

Q50: Granting a tax deduction for corporate interest

Q51: Financial leverage increases a firm's ROE and

Q52: Wayside Corporation has an EBIT of $2