Multiple Choice

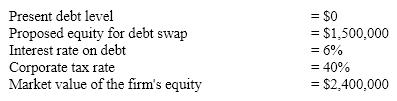

Assume the following selected financial information about a firm that is about to restructure capital by exchanging equity for debt:  Which of following would be true as a result of the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

Which of following would be true as a result of the restructuring according to the Modigliani-Miller model with taxes but without bankruptcy costs?

A) The new debt would contribute $600,000 to the value of equity due to its tax effect.

B) The market value of the remaining equity would be $1,500,000.

C) The total value of the firm would increase to $3,000,000.

D) All of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q65: Which of the following is not true

Q66: Leverage adds variability to financial performance when

Q67: Which of the following is correct?<br>A)Capital structure

Q68: According to MM, if we ignore bankruptcy

Q69: Operating risk is variability in a firm's

Q71: Operating leverage increases with the amount of

Q72: The formula for determining the degree of

Q73: The variability in a firm's EPS is

Q74: A firm's target capital structure is management's

Q75: The DFL quantifies the effect of leverage,