Essay

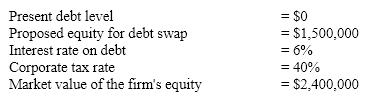

Assume the following selected financial information about a firm that is about to restructure capital by exchanging equity for debt:

a. If the firm operates in the world of the Modigliani-Miller model with taxes but without bankruptcy costs what would be the market value of its equity after the restructuring?

a. If the firm operates in the world of the Modigliani-Miller model with taxes but without bankruptcy costs what would be the market value of its equity after the restructuring?

b. By how much would the firm's total value and therefore shareholder wealth increase as a result of the swap? Explain.

c. Would we be able to answer the questions in part a and b precisely in the MM model with taxes and bankruptcy costs? Why?

Correct Answer:

Verified

a. Equity = $2.4M-$1.5M+TB=$.9M+.4($1.5M...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: A product has a contribution margin of

Q184: The Degree of Financial Leverage(DFL)quantifies the effect

Q185: If a firm's EBIT changes by 20%

Q186: A decrease in the level of a

Q187: If the degree of operating leverage is

Q189: The following chart shows the similarities between

Q190: Financial leverage amplifies relative changes in EBIT

Q191: In the MM model, the mix of

Q192: If k<sub>a</sub> represents the average cost of

Q193: The use of fixed-cost financing is referred