Essay

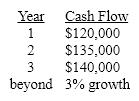

Lavender Inc. is thinking about acquiring Scarlet Corp. After all benefits, synergies and tax effects, Lavender's management has estimated that the incremental cash flows from the acquisition will be as follows

They have also estimated the project's discount rate, appropriately adjusted for risk, at 12%.

They have also estimated the project's discount rate, appropriately adjusted for risk, at 12%.

Scarlet is a privately owned firm with 50,000 shares of stock outstanding. How much should Lavender be willing to pay per share?

Correct Answer:

Verified

Terminal Value = $14...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: In general, the greatest economies of scale

Q95: The distinction between bankruptcy and insolvency is:<br>A)unimportant,

Q97: A merger between a tire manufacturer and

Q98: Golden parachutes are exorbitant severance packages offered

Q99: The Antitrust Laws:<br>A)may prevent mergers.<br>B)have been enforced

Q101: A junk bond is:<br>A)a low risk bond

Q102: Bumpstead Inc. is interested in acquiring Blondies

Q103: Match the following:

Q104: Activist investors unlike most individual investors, buy

Q105: In corporations that are said to be