Essay

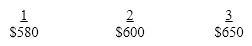

Tancesco Inc. is considering acquiring Aldine Corp. which it has estimated will generate the following after tax cash flows over the next three years ($000). After that management expects a growth rate of 3% indefinitely.

In addition, Tancesco thinks a merger will produce $40,000 per year in after tax synergies. Aldine has 65,000 shares of common stock outstanding. The company's beta is 1.6, the market is currently returning an average of 12% on stock investments and short term treasury bills are yielding 3%. What should Tancesco be willing to pay per share for Aldine if management is willing to value the acquisition over an indefinitely long time horizon?

In addition, Tancesco thinks a merger will produce $40,000 per year in after tax synergies. Aldine has 65,000 shares of common stock outstanding. The company's beta is 1.6, the market is currently returning an average of 12% on stock investments and short term treasury bills are yielding 3%. What should Tancesco be willing to pay per share for Aldine if management is willing to value the acquisition over an indefinitely long time horizon?

Correct Answer:

Verified

($000)

Discount rate: kx = kRF + (kM - kRF)bx ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Discount rate: kx = kRF + (kM - kRF)bx ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: A junk bond is:<br>A)a low risk bond

Q102: Bumpstead Inc. is interested in acquiring Blondies

Q103: Match the following:

Q104: Activist investors unlike most individual investors, buy

Q105: In corporations that are said to be

Q107: Defensive measures to prevent an unfriendly merger

Q108: A combination of two entities in which

Q109: Although the long-term economic and political implications

Q110: The maximum purchase price acceptable to the

Q111: Match the following: