Multiple Choice

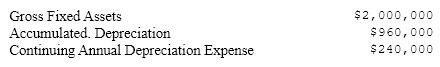

Toys For U, Inc. just purchased a new asset costing $500,000. The machine will be depreciated straight-line over a 10-year period using the convention of taking a half year's depreciation in the first year. Given the following information about old assets the firm already had, calculate net fixed assets at year end.

A) $765,000

B) $925,000

C) $1,275,000

D) $1,600,000

Correct Answer:

Verified

Correct Answer:

Verified

Q71: An accrual is best defined as:<br>A)A completed

Q72: The biggest difference between the income statement

Q73: Net book value is equal to market

Q74: A business's financial statements are numerical representations

Q75: The following is a listing of tax

Q77: Depreciation expense of $2,000.00 will cause:<br>A)Accounts receivable

Q78: The Adams Company purchased a piece of

Q79: Match the following:

Q80: EBIT shows the profitability of operations after

Q81: Taxable income is:<br>A)total income excluding exempt items