Essay

The following question(s)refer to the year-end account balances for UBUS, Inc. The accounts are listed in alphabetical order, NOT in the order they appear on the financial statements. The applicable tax rate is 40%.

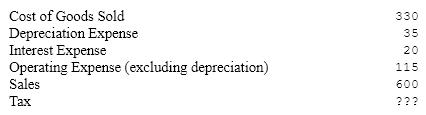

UBUS Income Statement

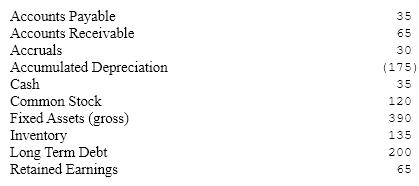

UBUS Balance Sheet

UBUS Balance Sheet

a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)?

a)What was UBUS Inc.'s earnings before interest and taxes (EBIT)?

a. $155

b. $120

c. $100

d. $215

e. $200

b)What is UBUS Inc.'s tax liability?

a. $48

b. $60

c. $55

d. $40

e. $35

c)What was UBUS Inc.'s Net Income?

a. $72

b. $45

c. $60

d. ($20)

e. $100

d)What is UBUS Inc.'s Total Assets?

a. $420

b. $570

c. $625

d. $450

e. $490

e)What is UBUS Inc.'s Total Equity?

a. $115

b. $120

c. $185

d. $205

e. $240

f)What is UBUS Inc.'s Net Working Capital?

a. $35

b. $70

c. $100

d. $130

e. $170

Correct Answer:

Verified

a) b $600-$330-$115-$35=$120

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q137: Why would a corporation purchase the stock

Q138: Which of the following best describes how

Q139: The taxation of proprietorships is about the

Q140: Leverage is the use of equity financing.

Q141: Differences between net income and cash flow

Q143: Albert Corp. bought a machine for $10,000

Q144: If a firm that's doing very well

Q145: What is the corporate tax paid by

Q146: Investors pay federal income taxes on the

Q147: Management is prone to overstate:<br>A)accounts receivable and