Essay

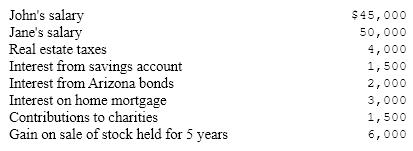

The following is a listing of tax considerations for John and Jane Alexander, who file jointly and have two children.

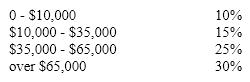

Assume the following hypothetical tax table:

Assume the following hypothetical tax table:

The personal exemption rate is $3,050

The personal exemption rate is $3,050

The long-term capital gains rate for this family is 18%.

a. How much is the Alexanders' taxable income?

b. What is the tax on their ordinary income?

c. What is their capital gains tax?

d. What is their overall average tax rate including the tax on capital gains?

e. What is their marginal tax rate on ordinary income?

Correct Answer:

Verified

a. Taxable income

Salaries + interest +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Salaries + interest +...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: The traditional income statement is intended to

Q65: The two forms of equity infusion are:<br>A)long

Q66: In the corporate tax system, higher-income taxpayers

Q67: Current tax laws:<br>A)Do very little to encourage

Q68: XYZ Inc. has taxable income of $14,000,000

Q70: The process of totaling all of the

Q71: An accrual is best defined as:<br>A)A completed

Q72: The biggest difference between the income statement

Q73: Net book value is equal to market

Q74: A business's financial statements are numerical representations