Essay

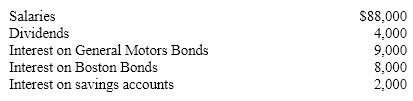

The Smith family has the following income

During the tax year they sold a vacation home for $65,000 that they had acquired several years ago for $58,000. They also sold some of their GM stock, receiving $22,000 after brokerage commissions. The shares had originally been purchased for $30,000. They paid $19,000 interest on their home mortgage and $3,000 interest on credit card debt. They paid state income tax of $7,000 and real estate tax of $3,000. They donated $2,000 to their church. They also paid $1,400 toward the support of an elderly parent. The Smith's have two small children. The personal exemption rate is $3,050. What is the Smith's taxable income? Show all calculations clearly.

During the tax year they sold a vacation home for $65,000 that they had acquired several years ago for $58,000. They also sold some of their GM stock, receiving $22,000 after brokerage commissions. The shares had originally been purchased for $30,000. They paid $19,000 interest on their home mortgage and $3,000 interest on credit card debt. They paid state income tax of $7,000 and real estate tax of $3,000. They donated $2,000 to their church. They also paid $1,400 toward the support of an elderly parent. The Smith's have two small children. The personal exemption rate is $3,050. What is the Smith's taxable income? Show all calculations clearly.

Correct Answer:

Verified

Ordinary Income: $88,000+$4,000+$9,000+$...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: In order to compare the yields on

Q54: Cost (of goods sold)includes only items that

Q55: The income statement line item that shows

Q56: One of the most significant exemptions for

Q57: Net capital losses incurred by individuals and

Q59: When a receivable is written off as

Q60: Which of the following is a current

Q61: Exxon Corp. bought an oil rig exactly

Q62: A local pizza restaurant purchased a delivery

Q63: Retained earnings are:<br>A)a liability<br>B)profits that have not