Essay

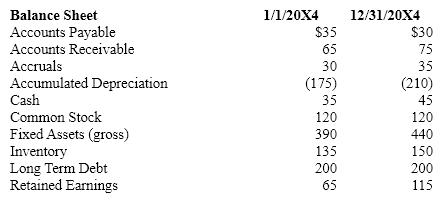

Listed below are the account balances for UBUS, Inc. The income statement balances are for the year, 20X4. The balance sheet balances are shown as of 1/1/20X4 and 12/31/20X4. They are listed in alphabetical order, NOT in the order they appear on the statements themselves. The applicable tax rate is 40%. You are to use this information to answer the following SEVEN questions (6-a through 6-g).

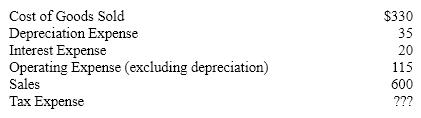

Income Statement for 20X4

a)What was the Quick Ratio for UBUS Inc. as of 12/31/20X4?

a)What was the Quick Ratio for UBUS Inc. as of 12/31/20X4?

a. Less than 1.0

b. From 1.0 - 1.5

c. From 1.51 - 1.9

d. From 1.91 - 2.3

e. More than 2.3

b)What kind of impact will the change in the Accounts Receivable balance have on Operating Cash Flows portion of the Statement of Cash Flows in 20X4?

a.Decrease operating cash flows by $10

b.Decrease operating cash flows by $5

c.Increase operating cash flows by $10

d Increase operating cash flows by $5

e. No impact

c)Where will the change in Fixed Assets (gross)appear on the Statement of Cash Flows?

a. The Operating Section

b. The Investing Section

c. The Financing Section

d. It won't appear on the Statement of Cash Flows

e. Can't tell from the information given

d)What is UBUS Inc.'s Times Interest Earned (TIE)ratio for 20X4?

a. Less than 2.0

b. From 2.0 - 3.0

c. From 3.1 - 4.0

d. From 4.1 - 5.0

e. More than 5.0

e)What is UBUS Inc.'s Return on Assets (ROA)for 20X4?

a. Less than 12.0%

b. From 12.0% - 12.5%

c. From 12.6% - 13.0%

d. From 13.1% - 13.5%

e. More than 13.5%

f)What is UBUS Inc.'s Return on Sales (profit margin)for 20X4?

a. Less than 9.0%

b. From 9.0% - 11.0%

c. From 11.1% - 13.0%

d. from 13.1% - 15.0%

e. More than 15%

g)What is UBUS Inc.'s Debt Ratio as of 12/31/20X4?

a. Less than 43.0%

b. From 43.0% - 46.0%

c. From 46.1% - 49.0%

d. From 49.1 - 52.0%

e. More than 52.0%

Correct Answer:

Verified

a) c (45 + 75)/(30 + 35) = 1.8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following ratios would probably

Q6: Explain the different types of activities presented

Q8: How does the Du Pont equation help

Q9: Which of the following would be classified

Q11: A decrease in accounts receivables is categorized

Q12: Financial analysts look for problems, things that

Q13: The statement of cash flow is divided

Q14: Triangle Systems had earnings after tax (EAT)of

Q15: Ratios are typically compared with similar figures

Q77: Free cash flow (FCF):<br>A)When positive indicates the