Multiple Choice

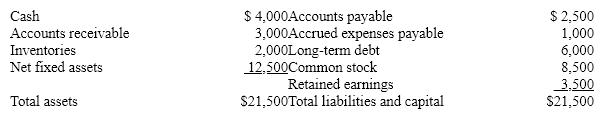

A firm has the following balance sheet. It expects sales to increase 30% over the previous year's level of $9,000, and anticipates retaining $3,000 of its earnings.  According to the un modified percentage of sales method, the amount of external funds needed will be:

According to the un modified percentage of sales method, the amount of external funds needed will be:

A) $2,400.

B) $6,450.

C) $3,450.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q70: Business planning that focuses on short-term financial

Q71: What is the debt/interest planning problem?<br>A)Planned debt

Q72: An operating plan:<br>A)translates business ideas into concrete

Q73: Although percentage of sales methods (modified and

Q74: The managerial value of planning includes:<br>A)the planning

Q76: Management wishes to reduce next year's external

Q77: Holding all other things constant, additional debt

Q78: The dividend payout ratio is defined as

Q79: Assume the following facts about a firm:

Q80: Top-down planning tends to reflect more excessive