Essay

Baxter Inc. is in a fast growing industry, but doesn't seem to be able to match its competitors' growth rates. Selected financial information for Baxter is as follows ($000):

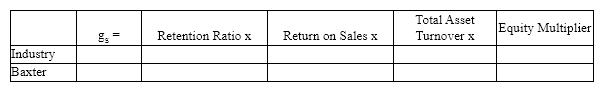

Research has revealed that the average firm in Baxter's industry pays out 10% of its earnings in dividends, earns 4 cents after tax on every sales dollar, has an equity multiplier of 3.0 and a total asset turnover of 1.9.

Research has revealed that the average firm in Baxter's industry pays out 10% of its earnings in dividends, earns 4 cents after tax on every sales dollar, has an equity multiplier of 3.0 and a total asset turnover of 1.9.

a. Use a sustainable growth rate analysis in the following table to determine the source(s)of Baxter's growth problems.

b. What negatives might be associated with fixing the problems revealed by the analysis?

b. What negatives might be associated with fixing the problems revealed by the analysis?

Correct Answer:

Verified

($000)

The analysis shows that Baxte...

The analysis shows that Baxte...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: This year's revenue is $2,000,0000 and the

Q96: The annual _ plan projects the business

Q97: Which of the following is true of

Q98: Although budgeting and forecasting appear similar, forecasting

Q99: A model of what management expects a

Q101: Business plans and the information they contain

Q102: Solving the debt/interest problem using an iterative,

Q103: A firm is planning to lower its

Q104: An important reason for making financial projections

Q105: Match the following: