Essay

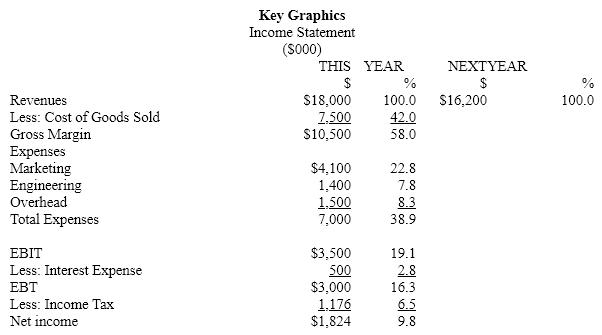

Key Graphics expects to finish the current year with the financial results indicated on the worksheet given below. Develop next year's income statement and ending balance sheet using that information and the following planning assumptions and facts. Note that due to an economic slowdown, Key Graphics is expecting a ten percent reduction in revenue. It is attempting to cut expenditures by an even greater percentage, resulting in a larger net profit. Work to the nearest thousand dollars.

PLANNING ASSUMPTIONS AND FACTS

Income Statement Items

1.Revenue declines by 10%.

2.The cost ratio will improve by 3%.

3. Spending in the Marketing Department will be held to 22% of revenue.

4. Engineering and Overhead expenses will be cut by 15%.

5.The combined state and federal income tax rate will be 40%

6. Interest on all borrowing will be 9 percent.

7. Interest expenses are based on 1/2 of the prior year's long-term debt and 1/2 of the current year's long-term debt.)

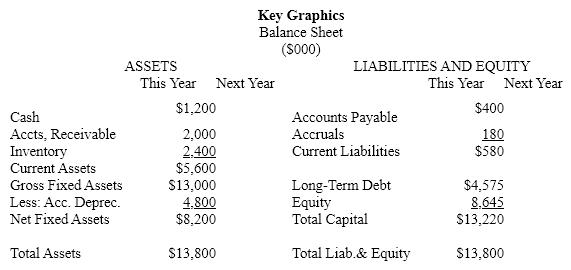

Balance Sheet Items

1.Cash balances will remain constant.

2. The ACP will be 30 days. (Use ending balances.)

3. The inventory turnover ratio will be 4 times. (Use ending balances.)

4. Capital spending is expected to be $6.0M. The average depreciation life of the assets to be acquired is 5 years and straight-line depreciation is used. Old assets will deprecation by $1,700,000.

5.Accounts payable is expected to be 40% of inventory.

6. Accruals will rise by $10,000

7.$1,500,000 of dividends will be paid.

8.There are no stock splits.

Correct Answer:

Verified

Total Liab.& Equity $13,800 $15,430

Total Liab.& Equity $13,800 $15,430

Su...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Su...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Small businesses usually create a single business

Q88: The budgeting process involves:<br>A)Predicting the amount of

Q89: Riordan Trucking has sales of $18M and

Q90: Which financial planning assumption does not have

Q91: Assume the following facts about a firm:

Q93: A good business plan conveys a comprehensive

Q94: The only goal of the planning process

Q95: This year's revenue is $2,000,0000 and the

Q96: The annual _ plan projects the business

Q97: Which of the following is true of