Multiple Choice

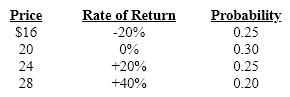

Phoenix Company common stock is currently selling for $20 per share. Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:  Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

A) 8%

B) 0%

C) 10%

D) 40%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Portfolio risk is best reduced through diversification

Q2: Stocks that have high financial rewards are

Q3: The risk premium for a stock compensates

Q4: The two distinctly different parts of the

Q6: The coefficient of variation is an absolute

Q7: Use the following information to calculate Overland's

Q8: Sally's broker told her that the expected

Q9: The slope of the characteristic line for

Q10: The _ is a statistical measure of

Q11: The range of possible outcomes for a