Multiple Choice

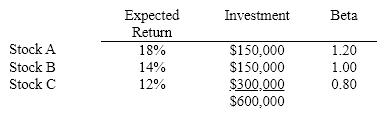

Assume a portfolio is made up of three stocks:  The portfolio's beta is:

The portfolio's beta is:

A) 0.95.

B) 1.15.

C) 1.00.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q60: Stock A has a required return of

Q61: The return that investors feel is most

Q62: If you invest 80% of your funds

Q63: The relation between the required rate of

Q64: According to portfolio theory, the most relevant

Q66: The risks associated with owning a single

Q67: Diversification eliminates unsystematic risk but does not

Q68: The larger the variance of the probability

Q69: Assume you want to construct a portfolio

Q70: Inflation, war, political upheaval, and other broad