Multiple Choice

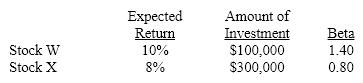

You have invested in stocks W and X. From the following information, determine the beta for your portfolio.

A) 0.85

B) 0.95

C) 1.00

D) 1.10

E) 2.20

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q37: The market risk premium is a reflection

Q38: When a new stock is introduced into

Q39: Assume a portfolio is made up of

Q40: A portfolio's beta coefficient is the weighted

Q41: Which of the following risks are unsystematic

Q43: Use the following information to calculate the

Q44: According to the Capital Asset Pricing Model

Q45: According to the SML, the risk premium

Q46: Risk aversion does not mean that investors

Q47: Which of the following is a correct