Multiple Choice

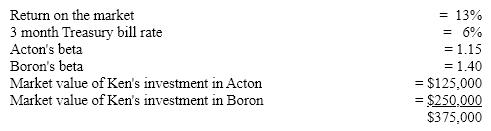

Ken Howard has a two stock portfolio consisting of Acton Inc. and Boron Corp. Assume the following conditions exist.  What does the SML predict is Ken's required rate of return for the overall portfolio?

What does the SML predict is Ken's required rate of return for the overall portfolio?

A) 15.24%

B) 14.93%

C) 23.12%

D) 20.90%

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Which of the following is a correct

Q48: Beta measures:<br>A)business risk.<br>B)risk aversion.<br>C)total risk.<br>D)market risk.

Q49: In general, investments yielding higher returns will

Q50: NM Mining Company has a standard deviation

Q51: Determine the beta of a portfolio consisting

Q53: Stocks with equal stand-alone risk can have

Q54: Kelly Brown has $12,000 invested in American

Q55: Which of the following is true regarding

Q56: McIntyre's stock is currently selling for $25

Q57: The principle of risk aversion can best