Essay

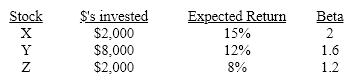

A portfolio is characterized by the following:

a. Calculate the portfolio's expected return.

a. Calculate the portfolio's expected return.

b. Calculate the beta of the portfolio.

c. If the return on the market is 10% and the risk-free rate is 3%, what is the required return on the portfolio?

Correct Answer:

Verified

a. Weights: Stocks X & Y = 2,000/12,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: The actual or expected return on a

Q91: The most likely outcome a random variable

Q92: Which of the following statements about the

Q93: The security market line can be thought

Q94: Betas are determined:<br>A)from the slope of the

Q96: Changes in the rate of inflation is

Q97: The SML shifts:<br>A)indicate an acceptance of beta.<br>B)parallel

Q98: Risk in finance:<br>A)is variability in return.<br>B)can be

Q99: You are considering purchasing a stock that

Q100: A stock's beta measures:<br>A)its performance.<br>B)market risk.<br>C)volatility in