Multiple Choice

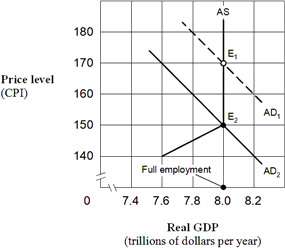

Exhibit 15-7 Aggregate demand and supply model  Beginning at equilibrium E1 in Exhibit 15-7, assume the marginal propensity to consume (MPC) is 0.90 and the government increases taxes by $100 billion. The aggregate demand curve will shift to the:

Beginning at equilibrium E1 in Exhibit 15-7, assume the marginal propensity to consume (MPC) is 0.90 and the government increases taxes by $100 billion. The aggregate demand curve will shift to the:

A) left by $1,000 billion.

B) right by $1,000 billion.

C) right by $900 billion.

D) left by $900 billion.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: If the spending multiplier is 3 and

Q43: Which of the following would most likely

Q75: Income tax collections:<br>A) fall during periods of

Q88: Exhibit 15-1 Disposable income and consumption data <img

Q89: Fiscal policy is the manipulation of government

Q91: Find the tax multiplier if the MPC

Q93: If an inflationary boom exists, the appropriate

Q95: Exhibit 15-1 Disposable income and consumption data <img

Q96: Assume the marginal propensity to consume (MPC)

Q97: Assume that an economy's real GDP multiplier