Essay

Instruction 5-1

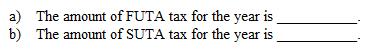

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

Refer to Instruction 5-1 . Niemann Company has a SUTA tax rate of 7.1%. The taxable payroll for the year for FUTA and SUTA is $82,600.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: In some states, employers may obtain reduced

Q16: Employer contributions made to employees' 401(k) plans

Q17: E-pay or a major debit or credit

Q18: Only employers who paid state unemployment taxes

Q19: Unemployment taxes (FUTA and SUTA) do not

Q21: Even if the duties of depositing the

Q22: Instruction 5-1 <br>Use the net FUTA tax

Q23: Christmas gifts, excluding noncash gifts of nominal

Q24: The Social Security Act ordered every state

Q25: On Form 940, even if the total