Essay

Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

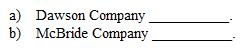

Refer to Instruction 5-1 . Michael Mirer worked for Dawson Company for six months this year and earned $11,200. The other six months he earned $6,900 working for McBride Company (a separate company). The amount of FUTA taxes to be paid on Mirer's wages by the two companies is:

Correct Answer:

Verified

Correct Answer:

Verified

Q83: If an employee works in more than

Q84: Which of the following is not a

Q85: In the case of an employee who

Q86: Services performed in the employ of a

Q87: Once a company attains the status of

Q88: An employer can use a credit card

Q90: In order to obtain the maximum credit

Q91: If the employer is tardy in paying

Q92: Leinart Company had taxable wages (SUTA and

Q93: In order to avoid a credit reduction