Essay

Instruction 5-1

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

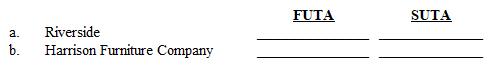

Refer to Instruction 5-1 . Ted Carman worked for Rivertide Country Club and earned $28,500 during the year. He also worked part time for Harrison Furniture Company and earned $12,400 during the year. The SUTA tax rate for Rivertide Country Club is 4.2% on the first $8,000, and the rate for Harrison Furniture Company is 5.1% on the first $8,000. Calculate the FUTA and SUTA taxes paid by the employers on Carman's earnings.

Correct Answer:

Verified

Correct Answer:

Verified

Q67: If an employer's FUTA tax liability for

Q68: A traveling salesperson who solicits and transmits

Q69: Voluntary contributions to a state's unemployment department

Q70: An aspect of the interstate reciprocal arrangement

Q71: If a business has ceased operations during

Q73: A bonus paid as remuneration for services

Q74: If a company is liable for a

Q75: For FUTA purposes, the cash value of

Q76: Partnerships do not have to pay unemployment

Q77: Jason Jeffries earned $10,200 while working for