Essay

Instruction 5-1

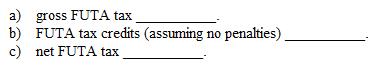

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

Refer to Instruction 5-1 . Queno Company had FUTA taxable wages of $510,900 during the year. Determine its:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q30: There is a uniform rate of unemployment

Q31: Even if a state repays its Title

Q32: Form 940 must be mailed to the

Q33: Truson Company paid a 4% SUTA tax

Q34: If an employer pays a SUTA tax

Q36: Services performed by a child under the

Q37: Which of the following provides for a

Q38: Schedule A of Form 940 only has

Q39: Instruction 5-1 <br>Use the net FUTA tax

Q40: Educational assistance payments to workers are considered