Essay

Instruction 5-1

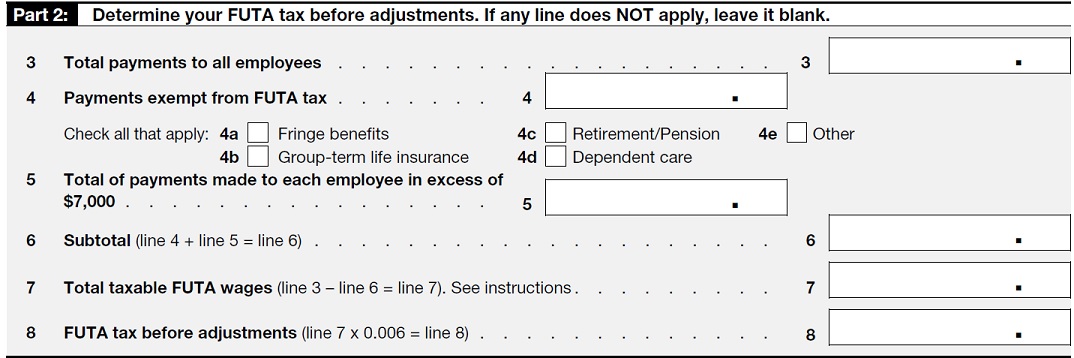

Use the net FUTA tax rate of 0.6% on the first $7,000 of taxable wages.

a. Complete Part 2 of Form 940 based on the following information:

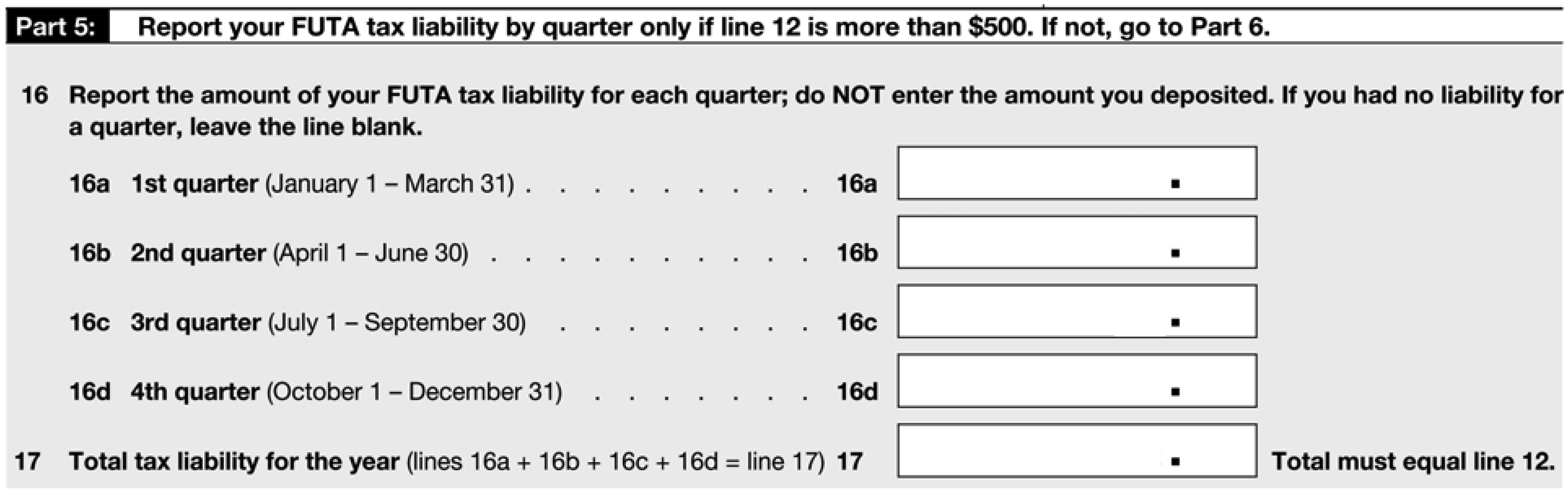

b. Complete Part 5 of Form 940 for the employer given the breakdown of FUTA taxable

b. Complete Part 5 of Form 940 for the employer given the breakdown of FUTA taxable

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q43: Employers have to pay a FUTA tax

Q44: The person who is not an authorized

Q45: For FUTA purposes, an employer must pay

Q46: If an employee has more than one

Q47: FUTA tax deposits cannot be paid electronically.

Q49: A federal unemployment tax is levied on:<br>A)

Q50: For FUTA purposes, an employer can be

Q51: Currently, none of the states imposes an

Q52: If an employer pays unemployment taxes to

Q53: All of the states allow employers to