Essay

Exhibit 6-1

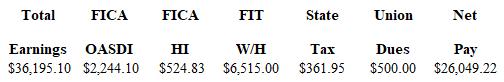

The totals from the first payroll of the year are shown below.  Refer to Exhibit 6-1 . Journalize the entry to record the employer's payroll taxes (assume a SUTA rate of 3.7%).

Refer to Exhibit 6-1 . Journalize the entry to record the employer's payroll taxes (assume a SUTA rate of 3.7%).

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: The total of the net amount paid

Q24: The adjusting entry to record the accrued

Q25: The payroll taxes account is an expense

Q26: The employers' OASDI portion of FICA taxes

Q27: Direct deposit of paychecks can be forced

Q29: FIT Payable is a liability account used

Q30: Since vacation time is paid when used,

Q31: FICA Taxes Payable-OASDI is a liability account

Q32: A debit to the employees FIT payable

Q33: Under the Consumer Credit Protection Act, disposable