Essay

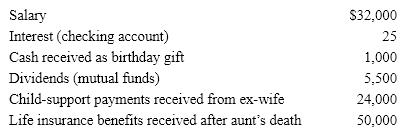

From the following information, determine Steve's gross income for tax purposes.

Correct Answer:

Verified

Steve's Gross Income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Steve's Gross Income...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q23: Jamie has taxable income of $45,000. She

Q24: Ben and Jack both earned $60,000 this

Q25: Tax avoidance is legal, whereas tax evasion

Q26: The highest marginal tax rate is currently:<br>A)

Q27: Based on the given information, what is

Q29: A taxpayer can file for an automatic

Q30: Schedule E of Form 1040:<br>A) reports the

Q31: INSTRUCTIONS: Choose the word or phrase in

Q32: Mr. and Mrs. Davenport, ages 40 and

Q33: A capital gain is the result of:<br>A)