Multiple Choice

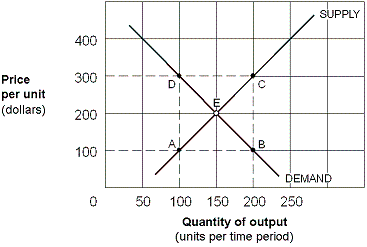

Exhibit 5-9 Supply and Demand Curves for Good X

In Exhibit 5-9, assume the government places a $200 per unit sales tax on Good X. The percentage of the burden of taxation paid by consumers of Good X is:

A) zero.

B) 25 percent.

C) 50 percent.

D) 100 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The more inelastic the demand for a

Q16: If the percentage change in the quantity

Q24: Along the elastic range of a demand

Q47: Exhibit 5-1 Demand curve<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9288/.jpg" alt="Exhibit 5-1

Q48: Exhibit 5-4 Demand curves for silver<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9288/.jpg"

Q52: Using the midpoints formula, what would be

Q70: Using supply and demand analysis, which of

Q99: If New York City expects that an

Q124: Any change in price along a perfectly

Q128: Suppose the quantity demanded is 1,000 million