Multiple Choice

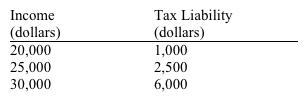

Use the table below to choose the correct answer.  The marginal tax rate on income in the $25,000 to $30,000 range is

The marginal tax rate on income in the $25,000 to $30,000 range is

A) 10 percent.

B) 20 percent.

C) 50 percent.

D) 70 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q73: Other things constant, an increase in the

Q76: If drugs such as marijuana and cocaine

Q131: About 35,000 general aviation multiengine airplanes are

Q143: A regressive tax<br>A) taxes individuals with higher

Q163: In 2010 the federal government reduced the

Q166: Suppose that the federal government levies a

Q174: A progressive tax is defined as a

Q219: A tax for which the average tax

Q249: Use the figure below to answer the

Q255: Figure 4-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-25