Multiple Choice

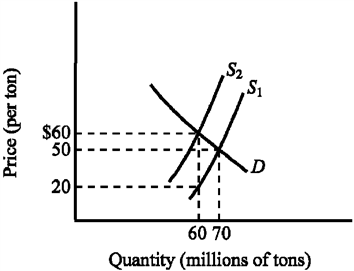

Use the figure below to answer the following question(s) . Figure 4-8 Refer to Figure 4-8. Which of the following is true?

Refer to Figure 4-8. Which of the following is true?

A) The tax increases the price of soft coal by $40 per ton.

B) Since the demand for soft coal is more inelastic than the supply, consumers bear most of the burden of the tax.

C) Since the demand for soft coal is more elastic than the supply, suppliers of soft coal bear most of the burden of the tax.

D) Since the supply of soft coal is highly inelastic, the primary burden of the tax is imposed on the consumers of soft coal.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: After the ban on the production and

Q2: A subsidy on a product will generate

Q32: A subsidy is defined as<br>A) a payment

Q90: Data from the effects of the substantial

Q124: Which of the following examples illustrates a

Q153: Use the figure below illustrating the impact

Q158: Rent control applies to about two-thirds of

Q182: If the demand for a good is

Q200: If the federal government began granting a

Q245: The market pricing system corrects an excess