Multiple Choice

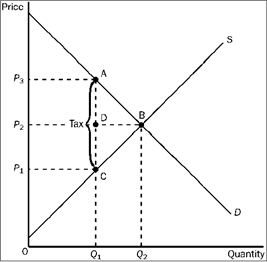

Figure 4-24  Refer to Figure 4-24. The per unit burden of the tax on buyers is

Refer to Figure 4-24. The per unit burden of the tax on buyers is

A) P3 − P1.

B) P3 − P2.

C) P2 − P1.

D) Q2 − Q1.

Correct Answer:

Verified

Correct Answer:

Verified

Q80: When a price ceiling prevents a higher

Q111: If Sophia's tax liability increases from $10,000

Q141: Figure 4-20 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-20

Q145: Figure 4-17 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-17

Q146: Figure 4-16 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX9063/.jpg" alt="Figure 4-16

Q149: A tax for which the average tax

Q157: If a government-imposed price floor legally sets

Q168: Which of the following is the most

Q195: An income tax is proportional if<br>A) the

Q268: The excess burden or deadweight loss of