Multiple Choice

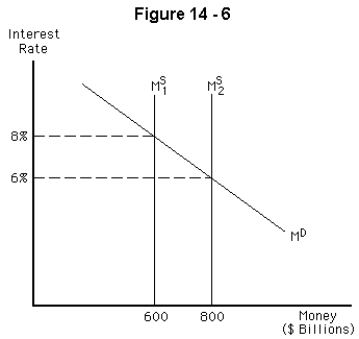

-Refer to Figure 14-6.Suppose the Fed increases the money supply (to ) .As a result,the interest rate falls initially to 6 percent.After spending and GDP change,what will happen to the interest rate?

A) It will remain at 6 percent.

B) It will rise as the money supply curve shifts back toward

C) It will rise as the money demand curve shifts to the right.

D) It will fall as the money supply curve shifts farther to the right.

E) It will fall as the money demand curve shifts to the left.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: If the price of bonds falls,the<br>A) demand

Q53: An increase in the money supply will

Q54: If Johanna purchases a bond for $4,500

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3972/.jpg" alt=" -Refer to Figure

Q56: Suppose the current interest rate is 5%

Q58: If the price of bonds rises,<br>A) the

Q59: An increase in government spending leads to

Q60: If the Fed wishes to raise the

Q61: The secondary market for bonds is a

Q62: A decrease in the interest rate shifts