Multiple Choice

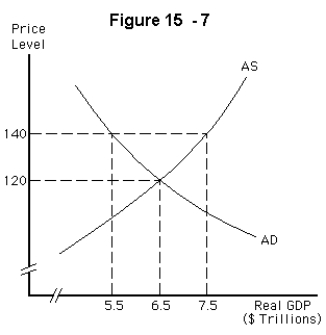

-Refer to Figure 15-7.If the economy is currently at a price level of 120 and real GDP is $6.5 trillion,an increase in taxes will,in the short run,

A) shift the aggregate demand curve rightward,increasing both the price level and real GDP

B) shift the aggregate demand curve leftward,decreasing both the price level and real GDP

C) shift the aggregate supply curve upward,increasing the price level and decreasing real GDP

D) shift the aggregate supply curve downward,decreasing the price level and increasing real GDP

E) have no effect on aggregate demand because of crowding out

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Which of the following is not an

Q43: A decrease in the price level<br>A) decreases

Q44: In the short run,a contractionary fiscal policy

Q45: Which of the following mechanisms helps output

Q46: After a negative demand shock,what are the

Q48: A movement along the AD curve down

Q49: A negative demand shock<br>A) shifts the AD

Q50: If the government announces a big tax

Q51: According the AS/AD model,in the long run,expansionary

Q52: Which of the following will shift the